By Elizabeth Walker, contributor

11/18/15

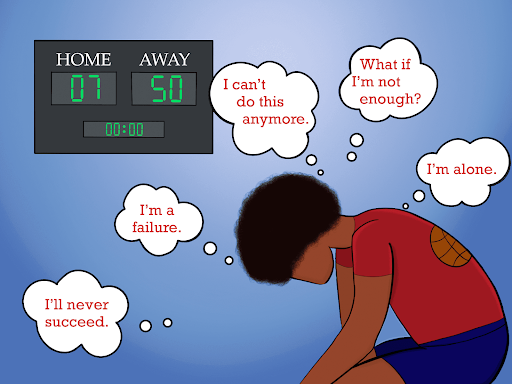

As college costs steadily rise, UNC Asheville students, faculty and staff concerns over impending financial stress increase as well.

“I think that over the last five years the one factor that has contributed in many cases is the larger financial stress. That, I think, plays a role,” said Brian Hook, humanities program director and associate professor of classics at UNCA, last month. “Paying for tuition and thinking about one’s career after school puts pressure on the performance in classes, and sometimes the learning is crowded into a corner because of the concern for a career.”

Yet, according to The Princeton Review’s 2015 “College Hopes & Worries Survey,” 90 percent of respondents said financial aid will be very necessary to pay for college.

“Where I’m at now, I feel like the past year in school has been completely useless because I did end up having to spend a lot of money on books and other random supplies. Now I can’t even continue my education, so it feels like what was even the point in the first place?” said Xela Phillips, a former political science and international studies student at UNCA.

Phillips said she had to take a semester off for financial reasons after her first year. While she wants to go back, she’s not sure if she’ll be able to return to school.

“Financial stress is probably a top concern, within the top five or ten. I don’t know if it is the No. 1 concern, just looking at the number of students we have to cancel for nonpayment versus students we have who are actually able to make the commitment and pay,” said Alexis Levenson, director of student accounts at UNCA.

Hook said the affordability of smaller colleges over larger colleges arises as another point brought up in most college expense debates.

“The public system overall is much less expensive than the private system. Many students I think who are here would have less financial stress, but it’s not always that way,” Hook said.

Hook said UNCA remains a cheaper school than Ivy League colleges such as Yale University, but Yale can be potentially cheaper for a student depending on the circumstances. Such colleges are need-blind — whatever a low income student can’t pay, Yale will pay the difference, Hook said.

“If you’re not paying anything and you were able to get (into Yale), then it might be a lot more stress at UNCA if you’re really struggling to cover an extra $3,000 a semester,” Hook said.

Levenson said a significant number of UNCA students take advantage of the financial aid that the school offers, whether it be loans, grants or even on-campus jobs.

“I have a lot of experience with financial aid because I went to a private high school where I was getting pretty much a full ride to school. While I was in high school, I was emancipated, and I had to figure out how I was going to send myself to college,” said Phillips, a Durham native. “I was also homeless at the time, so that made it relatively easy to get what I needed to go to college.”

Phillips said a friend of hers wasn’t able to drop a class to reduce his financial stress, so he must keep his full-time status and tuition while making ends meet with a part-time job.

“The situation is really quite a mess,” Phillips said.

A few methods to combat the financial stress of college remain. Levenson said UNCA offers a monthly plan through the outside company Tuition Management Systems as one of the possibilities for financial relief.

“Instead of having your full balance due Aug. 1, you can set that up and pay it out July, August, September, October, November. So that gives you five months to spread those payments out, and it is a really low cost option. There is no interest, there is a nominal enrollment fee,” Levenson said.

The 2015 Princeton survey found 39 percent of students’ concern was level of debt to pay for the degree.

Levenson said debt will always remain something that a student and a family need to consider. She said that the value of the education they are receiving relating to the job they want and what the job market value will be versus the cost of their education are factors to consider.

Phillips said she does not think a degree equates to the amount of debt students collect to pay for college, even though she said the college experience remains valuable.

“Plenty of people I know have degrees that were difficult to get but they work at Starbucks. The thing is, (people) see the jobs you can get with a college degree as being more valuable to society than whoever works at Starbucks,” Phillips said. “There’s a lot of shame, I think, that comes with pushing college degrees on people, and that ‘Oh you need to go to college or you’re not going to be a successful person.’ Who’s to say that person working at the gas station doesn’t feel successful in their life?”

Latest Stories

- What Do Blue Banner Staff Listen To?

- Asheville residents at odds over U.S. financial assistance to Ukraine

- The UNC Asheville Saber Club’s duels remain, moved to AC Reynolds Green

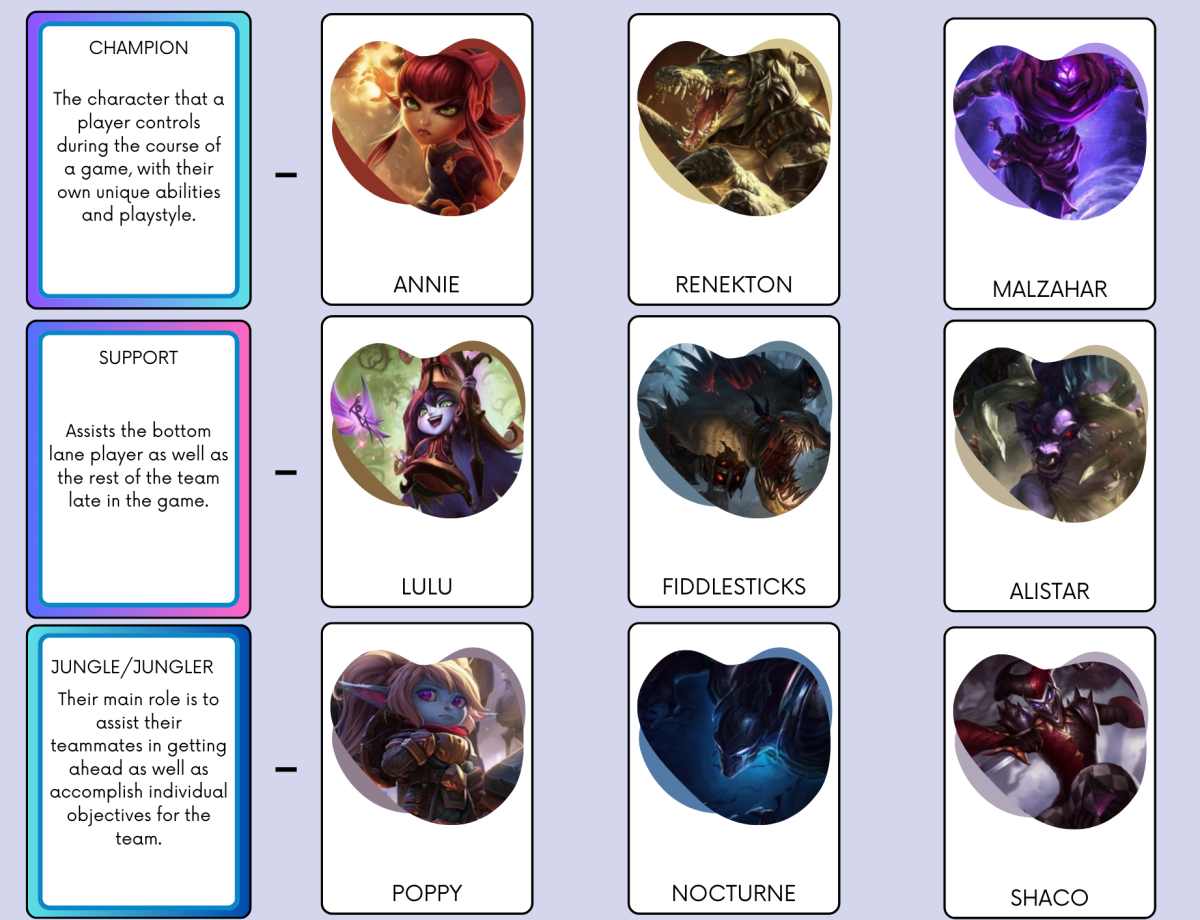

- UNCA League of Legends takes first in stunning finals match against HPU

- From passion to professional play: How a UNCA League of Legends MVP hit their stride

- Old UNCA sorority still has its footprints on campus

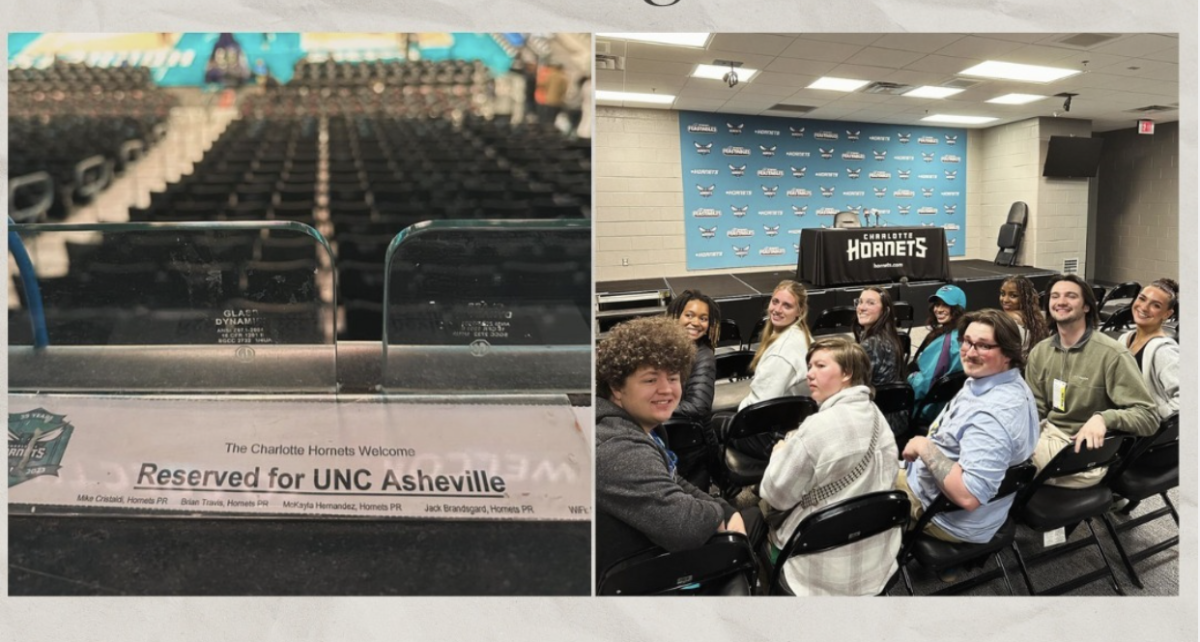

- Mass communication students visit Charlotte to watch Hornets game

- Blue Banner Connections #1

- Sex toys get luckier than traditionalist men

- A student's perspective on traveling and concerts